A Deep Dive into AI-Driven Share-Price Erosion, Revenue Losses, and the Investment Imperative

Executive Summary

The consulting industry’s old business model, billable hours, analyst pyramids, and a premium for human-delivered research, is being structurally re-priced. Generative AI and agentic platforms now perform much of the analysis, data cleaning, benchmarking and initial synthesis that historically required large junior teams. That shift is visible in market behavior: forward bookings declines, share-price re-ratings, hiring freezes and headcount reductions at top firms.

Accenture’s Q3 FY25 disclosures show new bookings of $19.7 billion, a 6% year-over-year decline, and investors punished the stock despite a revenue beat, the share price is trading roughly 40% below its 52-week high. McKinsey has reduced headcount by more than 10% over 18 months as demand patterns shift. Meanwhile, PwC’s enterprise survey shows broad adoption of AI agents: 79% of executives have begun using AI agents and 88% plan to increase AI budgets — a direct signal that clients are building internal capabilities that displace external advisory spend.

This is not incompetence on the part of consultancies, it is a shrinking market for their traditional product. For investors, the implication is simple but urgent: reassess exposure to legacy, billable-hours dependent consultancies; reallocate toward firms that productize advisory (platforms, AI-native boutiques), and favor outcome-based business models.

HQK Capital positions itself as the strategic partner for investors in this phase. We (a) identify consultancies at real risk of de-rating, (b) surface AI-native or hybrid firms with defensible IP and recurring revenue, and (c) structure investment plays that capture the upside of platformization while hedging legacy-model downside.

Why This Is a Structural, Not Cyclical, Shock

Historically, consulting enjoyed three durable advantages:

- Information asymmetry — consultancies controlled data, frameworks and benchmarking.

- Human capital leverage — pyramidal staffing with many juniors producing billable hours.

- Pricing power — clients paid for perceived exclusivity and reliability of insight.

The Market Signals: Bookings, Revenue, Headcount, and Share Prices

Market participants care more about forward visibility (bookings, pipeline) than one quarter’s revenue beat. Several concrete indicators show the industry re-pricing.

Accenture — The Canary in the Coal Mine

- Bookings: Accenture reported new bookings of $19.70 billion in Q3 FY25 — a 6% decline YoY — a sentinel indicator of weaker future revenue.

- Revenue: The company still reported Q3 revenue of $17.7 billion, an 8% YoY increase, which demonstrates that current execution is solid even as the future pipeline softens.

- Share Price Reaction: Investors punished the stock after the bookings decline, even though revenue beat; Accenture traded ~40% below its 52-week high at points in 2025 — illustrating the market’s focus on forward demand rather than past performance.

Why it matters: bookings fall because clients are deferring or shrinking scope — often a consequence of client adoption of AI tools or insourcing. When bookings decline, future revenue tails off and valuations re-rate downward even if current execution is competent.

McKinsey — Demand Shock and Cost Response

Headcount Reduction: McKinsey cut more than 10% of its workforce in a two-year profitability and restructuring drive, reducing its headcount from roughly 45,000 to ~40,000. This is both a response to slowing demand and a cost rationalization.

Why it matters: workforce reductions at top strategy firms are an explicit signal that demand for traditional consulting projects is softening, and firms are reshaping to preserve margins.

Broader Industry Signals

- Hiring pullbacks and delayed promotions at major players. (Industry reporting and surveys point to fewer entry-level openings and slower promotion cycles.)

- Share-price divergence: consulting and traditional IT services have underperformed many AI-native or cloud peers as markets reprice future earnings. (See Accenture’s substantial gap to its recent highs.)

How AI Translates to Lost Consulting Revenues

Three mechanisms explain the revenue and market-cap declines:

- Direct substitution: AI performs research, data processing, summarization and initial analysis that previously commanded junior hours. That reduces billed hours per engagement.

- Insourcing: Clients with scale (large corporates) build internal AI teams and reduce discretionary external advisory spend. PwC’s survey finds growing internal adoption and budget increases.

- Pricing Pressure: When deliverables are commoditized, clients resist premium fees; firms must either discount or pivot to higher value services. Booking declines are often an early sign clients have renegotiated scope or delayed projects.

Crucially, these effects compound: fewer billable hours → lower leverage → pressure on margins → valuation re-rating.

Company Case Studies — Deep Dive

Below are detailed, sourced analyses of the largest and most consequential consultancies.

Accenture — Execution Strong, Future Visibility Weak

Q3 FY25 highlights (Accenture IR): $19.7B bookings (-6% YoY); revenue $17.7B (+8% YoY); GenAI bookings and services growth noted, but not enough to offset booking declines.

Market response: despite beating revenue, shares fell as investors focused on bookings and guidance; the stock has been trading ~40% off its 52-week high, reflecting re-rating risk.

- Structural dynamics: Accenture’s scale gave it a durable moat for decades. But scale alone doesn’t protect against commoditization. Its investments in AI (internal training across hundreds of thousands of employees, productization efforts) are necessary but costly and uncertain to monetize quickly.

Investor implication: Accenture is a high-stakes “pivot” case — it has the balance sheet to invest, but the market demands clear evidence that AI investments convert into durable, higher-margin recurring revenue rather than only cost savings.

McKinsey — Strategy Firm Recalibrating

- Headcount reductions of >10% in 18 months. The firm has also faced legal and reputational costs from prior engagements that weigh on free cash flow and discretionary investment capacity.

- Demand pattern: clients are more selective on large-scale transformation projects; pilots abound but scaling to enterprise rollouts is inconsistent. McKinsey’s trimming reflects both cost discipline and reallocation toward higher-value, AI-enabled offerings.

Investor implication: For buyers of assets exposed to strategy consulting, McKinsey’s moves reflect broader demand smoothing and highlight the need to underwrite margin risk.

BCG & Bain — Growth with Guarded Optimism

- BCG reported ~10% revenue growth to $13.5B in 2024, but that growth increasingly stems from AI and digital transformation services (more implementation and product work, less pure strategy).

- These firms are expanding headcount in digital squads and product teams — a defensive move toward productized offerings.

Investor implication: BCG’s growth suggests strategic reorientation is possible; success depends on converting advisory into owned platforms and recurring relationships.

The Client Perspective: Why They’re Pulling Back

Clients are rational in a new environment:

- ROI focus: Clients demand measurable outcomes (cost savings, revenue growth), not just PowerPoint recommendations. AI enables faster cost-benefit analysis, exposing low ROI engagements.

- Lower switching costs: Cloud services, analytics vendors and open-source models reduce the barrier to building internal capabilities.

- Budget pressures: Macroeconomic restraint and operational scrutiny cause procurement to challenge high consultancy invoices.

The result is a shift in procurement behaviour: smaller scopes, outcome-linked fees, greater in-house capability — which translates to lower third-party consulting demand.

Forward Scenarios & Quantitative Impact

Scenario A — Rapid Platformization (Best case for incumbents)

- Firms successfully convert advisory into platforms, selling subscriptions and managed services. Booking declines stop as revenue mix shifts to recurring ARR. Valuations stabilize and re-rate for SaaS-like multiples.

Scenario B — Hybrid Transition (Most likely)

- Firms partially productize; margins compress but profitability stabilizes. Talent pyramids shrink; firm valuations compress but large players retain meaningful cash flows.

Scenario C — Commoditization Wave (Worst case)

- Clients fully insource and cheap AI boutiques capture former consulting volume. Large consultancies face prolonged margin contraction and significant market-cap losses.

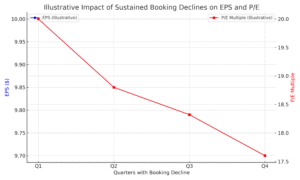

Key Takeaways: A sustained 5–10% decline in bookings over successive quarters can translate into a multi-point EPS reduction and a double-digit percentage de-rating of P/E multiples, depending on leverage and effective CAPEX ramp for productization.

Investment Playbook: How HQK Capital Acts

HQK Capital’s approach to this inflection includes four pillars:

- Forward-metric sourcing: We emphasize bookings, contract lengths, and AI-revenue mix rather than trailing revenue alone.

- Platform & IP bias: Allocate to firms demonstrating product/IP traction (vertical analytics platforms, embedded agent solutions).

- Outcome validation: Invest where client case studies demonstrate measurable ROI (cost takeout, revenue lift) — not just pilots.

- Active rebalancing: Reduce exposure to billable-hours models; increase exposure to AI-built services and boutique consolidators.

HQK Capital also offers bespoke diligence: we run client reference checks, validate case studies, and model future revenues under different adoption curves — helping investors avoid the “value trap” of brand names that lack forward economics.

Conclusion: The Investment Imperative

The consulting industry stands at a crossroads. The decline in forward indicators; bookings, pipeline and hiring; and market reactions to them (notably Accenture’s stock re-rating and McKinsey’s headcount reductions) are clear signals of structural change, not mere noise.

For investors, the choice is binary: continue to hold legacy consulting exposures and accept potential further value erosion, or re-allocate to AI-native consultancies, platform plays, and vertical specialists that can preserve pricing power through differentiated, outcome-oriented offerings.

HQK Capital is positioned to help investors make that transition. We combine proprietary analytics, forward-looking metrics, and execution-level diligence to separate talkers from doers, and to invest in firms building the future of advisory rather than clinging to its past.

Write to us at info@hqkcapital.com to know more.

Disclaimer

The views, opinions, and analyses expressed in this blog are those of the author and do not necessarily reflect the official position or investment strategies of HQK Capital. The content is for informational and educational purposes only and should not be construed as financial, investment, or professional advice.

While every effort has been made to ensure the accuracy and reliability of the data and information presented, no representation or warranty is made regarding its completeness or accuracy. Market conditions, economic factors, and investment outcomes are subject to change, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions.

HQK Capital and its affiliates assume no liability for any losses or damages resulting from reliance on the information provided in this blog.

For more details, please review our Disclaimer at www.hqkcapital.com.